Texas Rebates Solar Power – There are many forms of solar power rebates. These include small-scale technology certificates and Federal tax credits. These rebates are available to help you pay for your solar energy system. Find out more about these rebates. Below are some examples of rebates that may be available.

Small-scale technology certificates

The STC is a certificate that can be used to claim a solar power rebate. The STC is calculated using the Small-scale Renewable Energy Scheme’s (SRES), which takes into account the date of installation, the location and the amount of electricity the solar PV system can generate over its lifetime. STCs are issued for up to 20 years, although the deeming period will decrease each year as the scheme nears its end.

STCs can be issued for panels with solar photovoltaic power less than 100 kW. They are produced as a result of the SRES, an initiative by the federal government to encourage the use of small-scale renewable energy systems. These solar panels can generate up to a megawatt hour of electricity, and the number of STCs issued will depend on the installation date and location.

STCs can be purchased, sold, or traded to offset the cost of solar panels and other small-scale technologies. In Australia, you can obtain up to $2700 in rebates by using small-scale technology certificates.

Federal tax credit

People who use solar power to power their homes or businesses can claim a Federal tax credit. But if you want to claim the credit, you need to own your solar PV system. It cannot be leased or purchased through a solar power purchase agreement. Nevertheless, the credit does cover solar PV cells, panels, wiring, inverters, and other solar system components.

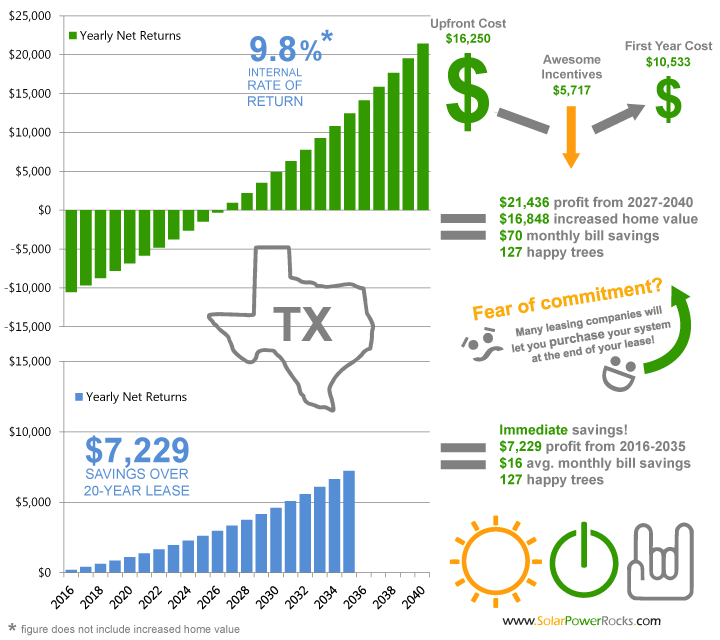

The 2005 Energy Policy Act created the solar investment tax credit. Although originally scheduled to expire in 2007, it was extended several times by Congress due to its popularity with homeowners. The solar tax credit will rise from 26% to 30% starting in August 2022. The credit will remain at this level until Jan. 1, 2033. After that, the credit will gradually decrease to 22% and eventually phase out entirely in 2035.

Installing a solar photovoltaic panel on their primary or second residence is eligible for a Federal tax credit. The homeowner must finance the system and have it installed at their primary or second residence. It is also possible to qualify if you are part of a community solar project.

State sales tax exemption

New York State Department of Taxation and Finance recently published a publication that explains its exemptions from sales tax for solar energy systems. This publication details how to apply for the exemption as well as details about the rates applicable to solar energy equipment in each jurisdiction. The publication also offers additional information about the process. This publication is an excellent resource for those interested in solar energy for their homes and businesses.

There are 48 different rates for residential solar energy systems and 93 different rates for commercial solar energy systems. However, only eight jurisdictions have opted to provide a 0% rate exemption for commercial systems. In addition, significantly more local jurisdictions are now taxing electricity generated by commercial solar energy systems.

Another incentive is to look into solar tax exemptions. These incentives can help to reduce the initial cost of solar panels. Although these tax benefits are not available in every state, they can make solar panels more affordable. For example, a state sales tax exemption may reduce your solar installation cost to as little as $16,000, making the total investment in solar a more affordable option.

Net metering

Net metering allows homeowners to get credits from their local utility companies in return for their excess solar electricity. There are a few conditions that must be met to qualify for net metering. For starters, it must be owned by the same customer, be located on the same property, and be part of the same load zone. The New York Independent System Operator sets these parameters and reserves the right to investigate individual customer accounts. In addition, net metering accounts must be metered separately and be operated separately from other solar projects.

Net metering works to reduce the overall cost of electric power, which benefits consumers and the environment. By reducing demand for electricity, the program decreases the need for transmission upgrades and contributes to the reliability of the electric grid. In addition, it creates jobs in the solar supply chain. Today, the solar industry employs 250,000 people in the US and is one of the fastest growing industries in the country. The strong state net metering policies have helped this industry flourish.